Bill Pay is an easy, convenient way to make individual or recurring payments from your bank account.

Wouldn’t it be wonderful if your bank handled the task of paying your bills each month? Well, it can! Online bill pay is a service most banks and credit unions offer through their online banking programs that can pay bills using funds from a customer’s bank account.

At Chambers Bank, our Bill Pay service is free, simple to set up, and accessible 24/7 through Chambers Online Banking and Mobile Banking. In this blog, you will learn more about what Bill Pay can do, its benefits, and how to get started using it.

How Does Chambers Bank Bill Pay Work?

Bill Pay connects to the Chambers account you normally pay bills from and moves money from that account to designated payees either electronically or by bank-issued checks.

You can use this service to pay for recurring obligations like rent, mortgages, utilities, and credit card charges as well as occasional or one-time charges like furnace repairs and lawn care. Once you schedule who you need to pay, the dollar amounts, dates, and the frequency of payments, Bill Pay automatically pays those bills on your behalf.

In addition, you can set up Bill Pay to receive eBills, which is an optional Bill Pay feature that turns your paper bills into electronic ones.

If you choose to receive eBills, your payment statements arrive in your Bill Pay account when generated by providers and Chambers Bank pays them according to your specifications. Account balances, transactions, and statements from providers are always viewable from the BillPay platform.

One more thing to note … with recurring bills, you can choose two types of auto-pay options:

- Auto-Pay in response to an eBill. This is an automatic payment you set up in which a payment is triggered every time an eBill is received. You can choose to have Chambers Bank pay the bill in full, pay the minimum amount due, pay nothing and just file the bill. You can also create a rule for when to pay the bill—either upon receipt or on a specific date before the eBill is due.

- Auto-Pay at regular intervals. This is an automatic, recurring payment that you set up by establishing the details of how a payment should be made—including the frequency, amount of payment, start date, end date, and total number of payments to be made.

How Do I Set Up Online Bill Pay?

Setting up Bill Pay is easy! In fact, you can do it in five minutes or less if you’re already enrolled in Chambers Online Banking. If you don’t have Online Banking, click here to sign up first. Then simply follow these steps:

Step One: Log into Chambers Online Banking and select Bill Pay at the top of your screen.

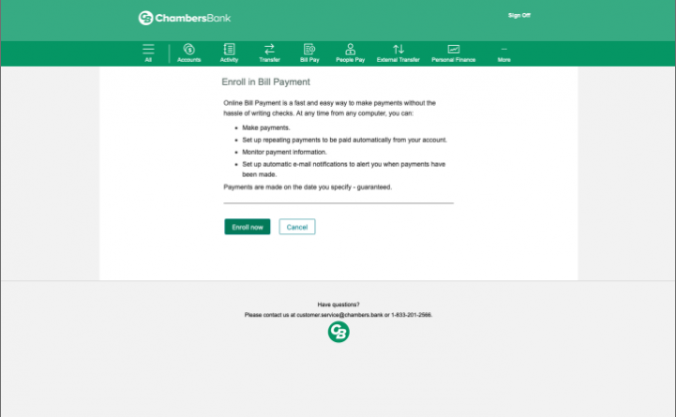

Step Two: The “Enroll in Bill Pay” screen will appear; select “Enroll now” to begin.

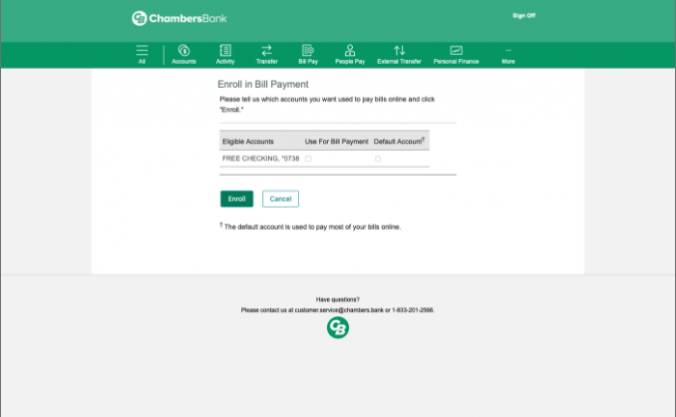

Step Three: Click the radio button for the account that will be your Default Account.

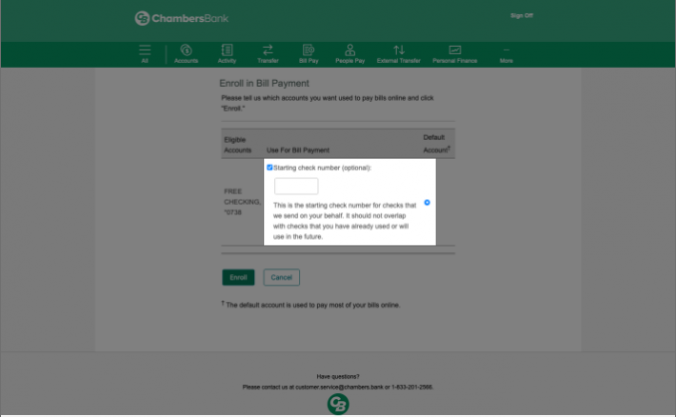

Step Four: Click the Starting Number checkbox and enter a check number if you would to have a separate sequence of check numbers for bill payments (this is optional).

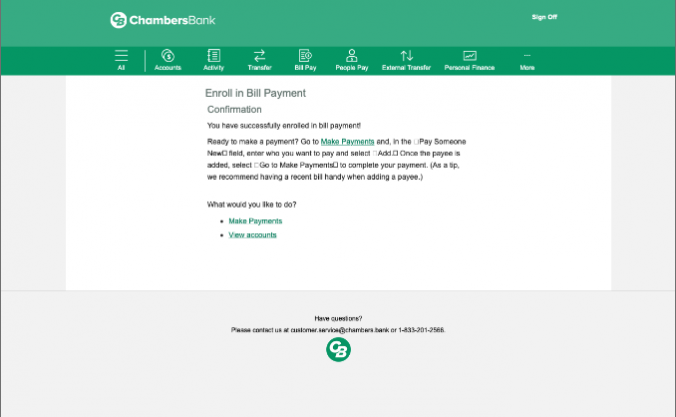

Step Five: You will receive a confirmation message after successfully enrolling. From here you can start adding payees.

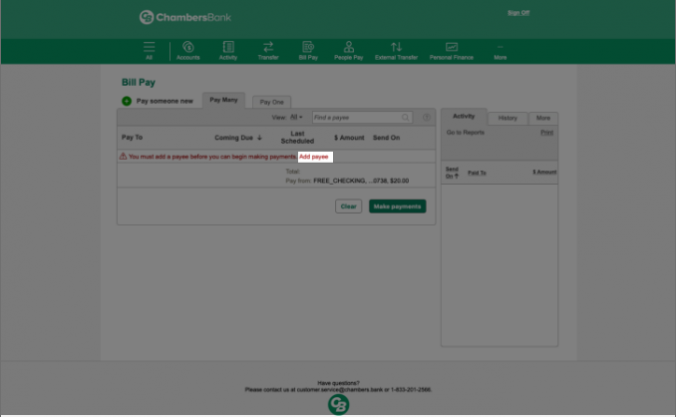

Step Six: Use printed copies of your bills and click on the red “Add Payee” link to begin adding each biller to your Bill Pay service.

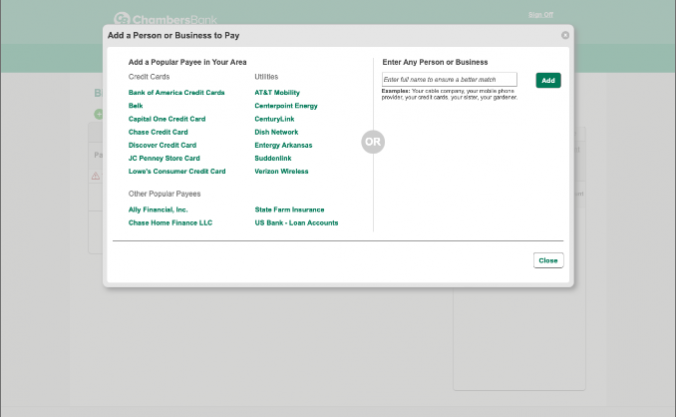

Step Seven: Select from among one of the popular payees in your area or enter any person or business in the search bar on the right-hand side of the window.

Step Seven: If you select one of the popular payees, you will be prompted to enter your account number. If you search for a payee, a list of suggested matches may appear.

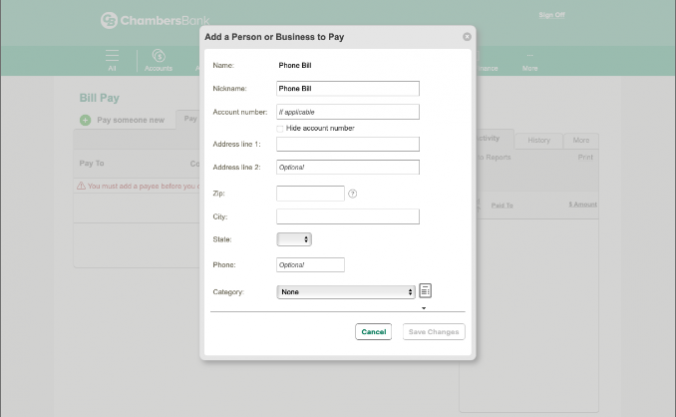

Step Eight: If no match is found, you will be prompted to enter a payee account number (optional), address, phone number (optional) and expense category.

Benefits of Online Bill Pay

It’s Convenient. With Chambers Online Bill Pay, you can manage all of your bills from a single platform instead of from multiple websites and apps. This not only helps you keep payments organized, but it also reduces the potential for online fraud since you’re not logging in to so many websites with your credentials, passwords, and bank account information.

Additionally, because Bill Pay is accessible from anywhere with an internet connection, you can manage bills while you’re on the go. And since Bill Pay can do check writing and remittance on your behalf, you no longer need to manually write checks and mail payments out.

It's Reliable. For many people, keeping track of bills is one of the more tedious parts of money management. Besides watching due dates, it takes time and energy to sit down and pay bills online, write checks, and mail out payments. But once you set up Bill Pay, Chambers Bank automates payments according to your specified due dates—a function that helps you avoid late fees, service interruptions, and damage to your credit score.

Bill Pay also allows you to set up auto-email notifications to alert you when payments have been made on your bills. If you’ve signed up for eBills, you can additionally set up email alerts to notify you when a new eBill arrives in your Bill Pay account.

It’s Secure. Bill Pay is a safe way to pay all your bills online, and Chambers bank uses several methods to ensure your information is always secure:

- Encryption. Chambers Bank uses 128-bit encryption to make information unreadable as it passes through the internet. This type of encryption is one of the strongest methods available today.

- SSL. This stands for secure socket layer, which is an encryption security protocol that creates a safe link to your transactions and keeps your information private and secure.

- Automatic Sign-Out. If you’re using Chambers Online or Mobile Banking and your session becomes inactive, the connection will time out automatically after a short period of non-use. This prevents someone from accessing your session if you step away and also keeps you off public Wi-Fi if you forget to log out and your mobile device picks up a connection.

It's Environmentally Friendly. By enrolling in Bill Pay and eBill services, you help reduce paper waste by lowering or eliminating the number of paper statements mailed to you and lowering the number of paper checks and envelopes that get mailed to your payees.

Bill Pay Challenges

Potential for Overdraft. The payments you schedule through Bill Pay will attempt to process even if you don’t have sufficient funds in your account. That said, to avoid overdraft fees and late payment penalties, always make sure you have sufficient funds available, have a back-up account linked so funds can be transferred to cover the charges, or sign up for Chambers Bank Overdraft Privilege or Overdraft Protection.

You May Overlook Fraudulent Activity. Once bills get automated, it becomes easier to check a bank account less frequently since you don’t have to log in and run manual transactions. But relying on this type of convenience could mean that you miss account errors or fraudulent activity so make sure you still check your account at least several times a week.

Ready to Pay Your Bills Online?

As you can tell from reading this blog, Bill Pay has a lot of advantages that help you save time and money on everyday financial matters. If you have questions about how to enroll in Bill Pay or how to use its features, please contact us at 1-800-603-1226 for more information.